Podcast: Play in new window | Download

Subscribe: RSS

How do you build philanthropy into your financial plan, even when you’re starting small?

Arlene Cogan

Arlene Cogen is a sought-after speaker on leadership and philanthropy. A Certified Financial Planner and expert on giving, Arlene provides a fresh perspective on how to include philanthropy in your life.

Her passion is reflected in the inspiring and informative presentations that she delivers at companies like First Republic Bank, Financial Planning Associations and Estate Planning Councils.

Arlene began her career on Wall Street, spending over 20 years in the trust and investment world. Wanting to lead by example for her daughters, she transitioned into nonprofit development and helped guide the ninth largest community foundation in the country for almost a decade.

Arlene is the Amazon #1 Best Selling author of Give to Live: Make a Charitable Gift You Never Imagined.

What We Discuss With Arlene Cogen In This Episode

- How she got into the consulting world of philanthropy

- The T.I.M.E. program for advisors

- The benefits of generosity

- The simple formula of perpetual giving

- Getting started with your philanthropic journey

- Companies combining purpose and profit

Transcript Highlights

Leaving Wall Street and Becoming a Philanthropic Consultant

Moving from Wall Street to Connecticut and to Oregon, Arlene wanted to find something personally rewarding that would lead by an example for her daughters. So she took a leap of faith working with the Oregon Community Foundation for nine years, bringing in 30% to 40% of all giving and making her the top fundraiser.

While she was at the Community Foundation, a person named Fred, who was worth about $200 million and had no children, passed away. When he left most of the money to the Oregon Community Foundation, all the investment advisors lined up wanting to continue to manage Fred’s money. She figured there has to be a better way for advisors to help manage their clients’ money and do philanthropy.

This inspired Arlene to not only focus on changing Oregon, but on transforming the world through teaching people how to give. By incorporating philanthropy generationally with clients, they have the opportunity to retain the next generation of assets under management.

The T.I.M.E. Program

Arlene uses the T.I.M.E. program in helping advisers teach their clients now and engage the younger generation to be able to retain more assets under management.

- Tools – This includes charitable remainder, trust, donor-advised funds, giving through the estate plan in a manner that’s very approachable.

- Intention – What do you as an advisor have back to your vision? How do we incorporate the intention of philanthropy into your practice?

- Meaning – What are their values?

- Engagement – Who do they want to participate? How do we start to engage that next generation?

The Benefits of Generosity

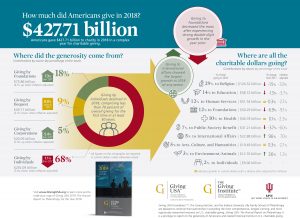

Happiness is a key benefit of generosity and giving. There’s hard science that giving money away makes you happy.

The ability to engage in those conversations of generosity allows you to pass down to your family the values and life lessons and stories that made a difference in your lives.

Finally, giving allows you to make a difference in your community.

The Simple Formula for Perpetual Giving

You might be giving to a foundation annually. But when you die, they don’t get that money anymore. If you want to continue giving money to a foundation or organization even after your death, you can leave them a gift in your estate plan that would endow and give them that money in perpetuity.

For example, take your annual gift of $100 and multiply it by 20. Now, that’s $2,000 worth of endowment to an organization. With a 5% payout, you’re still actually paying them $100 a year in perpetuity. In order to avoid attorney’s fees, put a beneficiary designation on a retirement account for $2,000 to that organization.

You may also reach out to a community foundation and create a designated fund that would pay out that 5% every year to them.

How to Get Started with Your Philanthropic Journey

Read Arlene’s book, Give to Live: Make a Charitable Gift You Never Imagined to get more ideas and information.

Start tracking the giving that you’re currently doing.

Instead of creating funds for when you pass away, you may already create current funds so you can actually see where your giving takes you.

Create that governance structure to make sure aligning your values with where you’re giving.

The Benefits of Philanthropy to Companies

It’s driving more business to you because your name is out there and it’s visible to you.

You’re going to have more engaged, fulfilled, and satisfied employees because you’re making a difference beyond their work life.

Episode Resources

Connect With Arlene Cogen

- Website: www.arlenecogen.com

- LinkedIn: www.linkedin.com/in/arlenecogen

- Facebook: www.facebook.com/arlenecogen

- Twitter: www.twitter.com/arlenecogen

Did You Enjoy The Podcast?

If you enjoyed this episode please let us know! 5-star reviews for the Leaders Of Transformation podcast on Apple Podcasts, Spotify, Pandora or Stitcher are greatly appreciated. This helps us reach more purpose-driven entrepreneurs seeking to make a positive impact in the world. Thank you. Together, we make a difference!

Additional Episodes You May Like

- 310: Wendy Steele: Empowering Women and Transforming Lives

- 294: James Lenhoff: Transforming Our View of Money and Generosity

- 290: Paul Edwards: Becoming A Radically Generous Entrepreneur

- 272: Martin Barrett: Increase Your Marketing ROI Through Shared Generosity

- 040: Heidi Cuppari Part 2: Investment Tips For Aligning Your Money To Your Soul Purpose

- 039: Heidi Cuppari Part 1: Aligning Your Money To Your Soul Purpose